2024 is undoubtedly the year of the election. More than 40% of the world’s population will vote in some form of democratic (or faux-democratic) process this year. Perhaps in the UK we should be thankful our contest is essentially between two fundamentally decent centrists – albeit both of whom are having to manage noisy extremes on their parties’ fringes. Meanwhile, Europe has started embracing some of those extremes and the US becomes increasingly more polarised, as other parts of the world lean ever more towards autocracy.

It’s very common to be asked “how’s business?” or “how’s the market?”. For the past 7 or 8 years I have found my response starting with “despite…” This could be followed by Brexit, political turmoil, inflation, interest rates, Ukraine, China, the Middle East, etc.

Indeed, “despite” this conveyor belt of adversity, the UK economy flirted only briefly with a recession, the stock market is emerging strongly after a prolonged lacklustre period, and the domestic housing market has continued its relentless rise, only slipping back over an 18-month period before picking up again recently. Unemployment is near rock-bottom, and inward investment to the UK and GDP growth are arguably outperforming our main European competitors.

Yet despite (that word again) the relatively benign economic backdrop, the prime London residential market has been a disappointing performer throughout the past decade – in large part due to the actions of politicians. The upper end of the residential market has been hammered by tax changes which began back in 2012 but have gathered pace since. This is in no way unique to the UK; residential property prices are a political headache in much of the developed world today.

LABOUR’S WELCOME BULLDOZER

As we prepare for the new British Government to take office next month, we feel taxation on property is at its limits in its current format, particularly given the widely anticipated abolition of non-dom status. It’s clear that the UK needs more housing at affordable prices relative to earnings – and its’ worth being reminded that the UK national average house price is currently circa £300k. A Labour administration with a large majority, acting with ambition and purpose, could drive a bulldozer through our rigid planning laws and kickstart a national housebuilding programme which traditionally Tory-voting NIMBYs have frustrated. This would address the fundamental need and hopefully turn the spotlight away from a minority sector of super high-value properties that raise a relatively modest sum of tax and which would be of little impact relative to the problem, even if they were to be halved in value.

UNTAPPED VALUE?

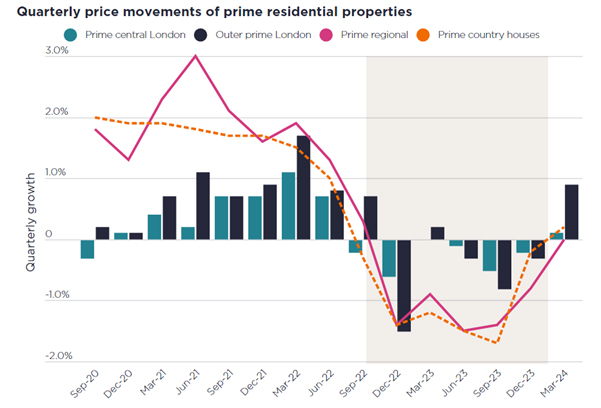

Source: Savills Reasearch

For those looking for value, prime central London prices – more so in the £2m to £5m bracket – now feel genuinely discounted after 10 years of zero growth, cumulative inflation amounting to around 26%, and an exodus of buy-to-let investors. Recent sharp increases in rents (up around 38% across central London over the past decade), with further upward pressure likely for some time to come, point towards a healthy yield carry, once interest rates start to fall as expected.

BUSY SUMMER AHEAD

Despite the changing political landscape, the Obbard and Obespoke teams are looking ahead to a summer of high activity as we complete several stunning homes and embark on a major new project in central London. New buyer mandates have picked up noticeably and we are continuing to exploit the rental market to our clients’ benefit.

Our branded hoarding has just gone up at 27 Upper Berkeley St W1 – a prominent Grade II-listed corner property which we’re redeveloping for combined residential and retail use. Brilliantly located between Portman Square and Marble Arch, the building had fallen into dilapidation in recent years but has huge potential. The owners selected Obbard not only for our specialist capabilities in listed and historic architecture, but also our track record in adding significantly to both asset value and rental premium. We’re scheduled to complete the work in spring 2025, after which we’ll take on responsibility for the site’s long-term rental and asset management.

A NEW FACE AT OBBARD

And finally… We’ve been delighted to welcome Luciana Palmisano to the Obbard team since our last news update. Luciana has taken on a key role in our business development operations and is working alongside the directors to identify new projects and opportunities for clients. A native of Sydney, Australia, and now based in London, she has also lived in Hong Kong, Japan and France, and has particular expertise in assisting buyers from the Far East looking to invest in and develop properties in the UK. So, if you’re considering your next transaction, or would like to know how Obbard could help you with your existing ownership, do drop Luciana an email (luciana.palmisano@obbard.co.uk).